Welcome back to After School Weekend Edition, a not-so-brief trends debrief for paid subscribers. Your support keeps this newsletter going!

In today’s letter:

The “I’m so hungry” prank

Why everyone’s say “Zahide won this trend”

Girls are plotting a “Carrie Bradshaw summer”

Reading as resistance (and merch)

The dating app all over my FYP

Perfume is the new status hoodie

The summer of the skort

Milkmaid dresses are back (did they ever leave?)

Why the Lorna Murray bonnet is going viral

And so, so much more, plus everything I’m buying, reading, and listening to. But first, my favorite TikTok of the week:

Tiktok failed to load.

Tiktok failed to load.Enable 3rd party cookies or use another browser

How young consumers are shopping beauty right now

Sephora has successfully positioned its spring sale, which they call their “annual savings event,” as one of the biggest beauty promotions of the year, even though it isn’t that good: a measly 10% off for most shoppers, 15% if you spend $350 a year, and 20% if you spend $1,000.

While the discounts aren’t particularly notable, how and what people are buying during the sale always reveals bigger shifts in beauty, from the categories gaining momentum to how consumers are thinking about value.

To track how beauty shoppers are spending right now, the team at Plot analyzed over 6,000 Instagram and TikTok posts that mentioned the Sephora sale between March 16 and April 16, 2025. They also dug into nearly 50,000 comments on those posts to get a sense of what shoppers were saying.

They looked for patterns like why people were buying, which products they cared about, and how they felt about prices. They also compared what paid ads looked like compared to regular posts and tracked what brands and products were mentioned the most. Here’s what they found:

Makeup still dominates: Makeup products — particularly face makeup like blush, concealer, and foundation — made up nearly half of all conversations, far outpacing skincare or fragrance.

Blush remains the breakout category: I’ve been theorizing that blush as a category had peaked, but it appears not. Blush was the most mentioned product category across the entire sale.

Lip products are having a glossy renaissance: Lip gloss, balm, and liner were heavily discussed, confirming a clear preference for hydrated lips over matte finishes.

Rare Beauty and Charlotte Tilbury dominate organically: These two brands topped the conversation through unpaid mentions.

Top product winners reflect the “natural but polished” look: Rare Beauty Soft Pinch Liquid Blush, Charlotte Tilbury Airbrush Flawless Setting Spray, and Huda Beauty Easy Bake Setting Powder were among the most-viewed products.

The sale itself drives behavior: 45.8% of posts cited discounts as the main reason for buying.

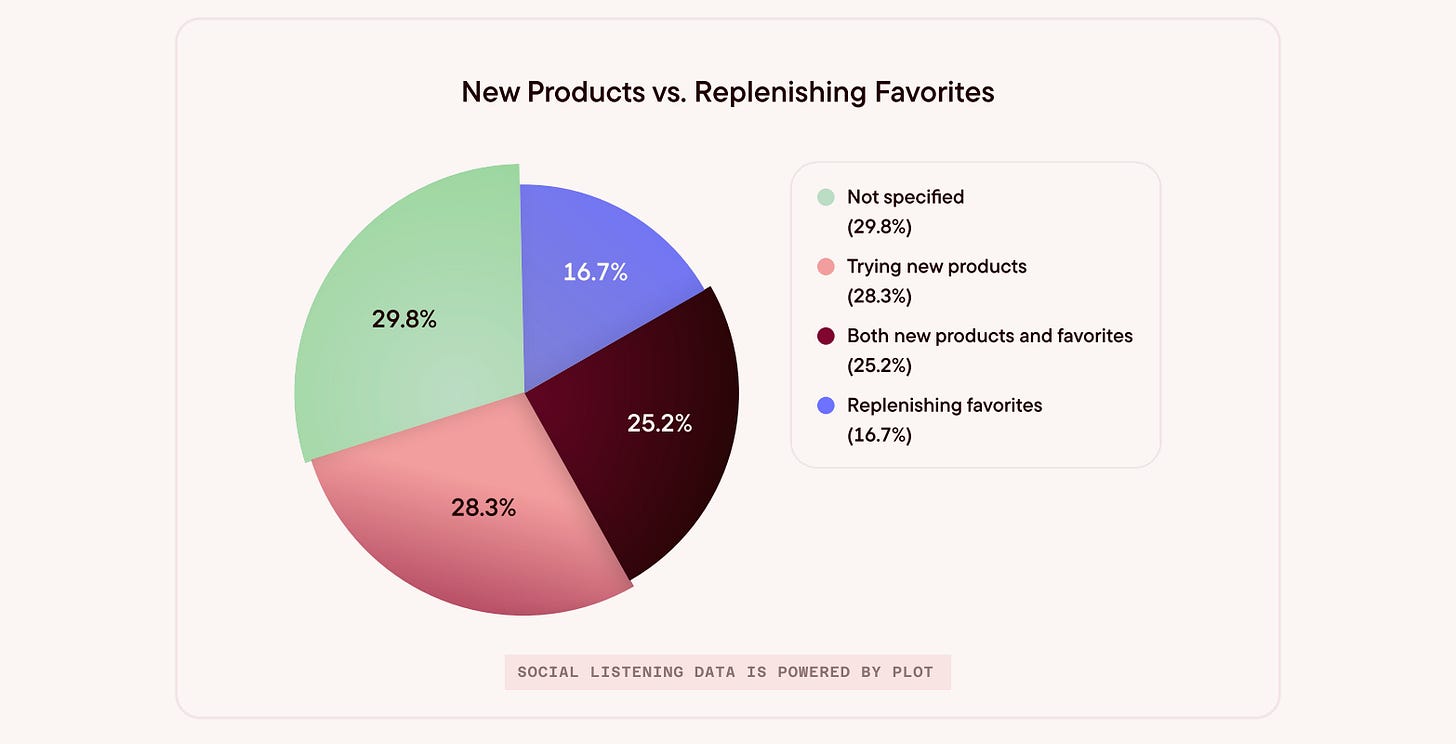

Product discovery is huge: Over half of consumers (51.6%) used the sale to try new products rather than just replenishing favorites.

Price sensitivity is growing — but it’s about value: Around a quarter of posts referenced price concerns, yet mentions of "dupes" were rare (only 5.2%). Shoppers want a deal on the good stuff, not a knockoff.

Beauty spending is framed as both “investment” and “treat”: Posts split almost evenly between treating purchases as justifiable investments (5.5%) and as indulgent splurges (5.4%), showing the hybrid mindset of today’s beauty consumer.

Read Plot’s whole report here.

A few quick developments on prom trends

I wrote about early prom trends a few weeks back, but now that more schools have had their big nights — and Google Trends dropped new data — we’re getting a clearer picture of what’s trending for Prom 2025.